Alejandro Servín, Head of Open Banking at BBVA, and Daniel Molano, Chief Growth Officer at Syncfy, took the stage at FINNOSUMMIT Connect 2023 to talk about the future of Open Finance automation and the benefits it brings to both companies and users.

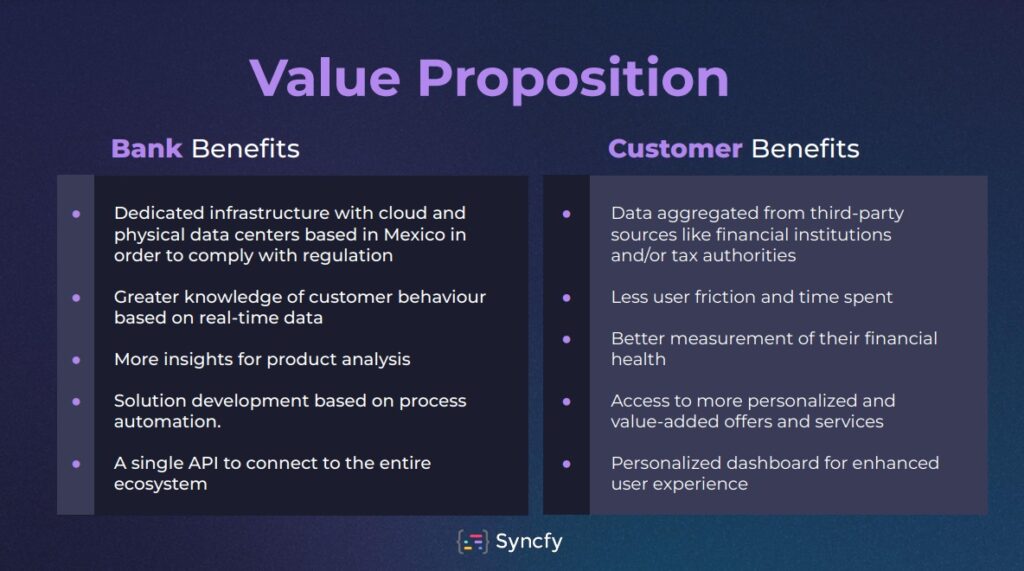

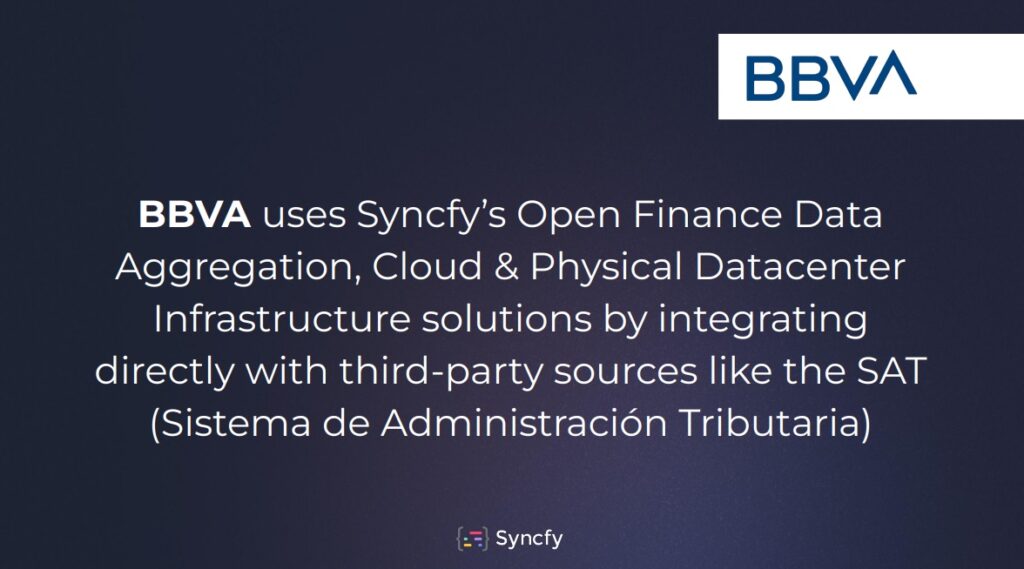

BBVA uses Syncfy’s Open Finance Data Aggregation solutions to deliver value-added services by integrating banking data with third-party sources such as the SAT (Tax Administration Authority in Mexico). Syncfy provides BBVA with a dedicated infrastructure with physical and cloud-based data centers in Mexico to comply with financial data management regulations.

The collaboration between Syncfy and BBVA aims to bring the great benefits of Open Finance to users of financial services in Mexico, including increased accessibility and transparency, enhanced security, and lower costs. It also promotes innovation and collaboration among financial service providers to create more advanced and personalized solutions for users.

Syncfy’s solutions allow the bank to expand its knowledge of its customers’ behavior based on real-time updated data, providing more information to analyze the creation of new products and services that the bank can offer to companies of all sizes.

Benefits for BBVA customers include aggregated data from third-party sources such as financial institutions and/or tax authorities for more accurate and timely measurement of their company’s financial health.

Other benefits for BBVA customers include reducing friction points and reducing the time spent on financial management, as well as having a personalized dashboard to improve the platform’s user experience. Additionally, BBVA will allow them to access more personalized and higher value-added offers and services.

The benefits for BBVA are multiple: adopt Open Finance solutions in compliance with the regulatory framework, real-time data use to better understand the consumer, and a single API to connect to the entire financial and tax ecosystem.

Alejandro Servín stated: “At BBVA, we will launch several Open Banking enabled products through which our customers can enjoy banking and financial solutions never before seen in Mexico. We will cover everything from account opening to movement consultation, payments, and credit requests on third-party platforms. Our alliance with Syncfy definitely strengthens our value proposition for an open and personalized banking experience.”

Syncfy’s services enable banks to expand their knowledge of their customers’ behavior based on real-time updated data, providing financial institutions with more information to analyze the creation of new banking products and services for the business market.

Syncfy also allows financial service providers to streamline the development of process automation solutions and have a single API to connect with the entire ecosystem.

Open Banking technology allows you to know the average balance, how much is spent, and on what in seconds, not minutes or days.

Once fiscal data is aggregated with Syncfy, banks can automate reconciliations: when bills are paid, it is quickly known thanks to having the customer’s tax ID that made the payment.

“With this type of solution, our clients’ fiscal and accounting operation is significantly streamlined. All of this without leaving our online banking platform. The main benefit is efficiency, increased usability, and improvement in our clients’ experience,” said Alejandro Servín.

Want to know what Syncfy can do for your company?

Contact us now: https://syncfy.com/contact